Our Products

Bespoke digital propositions across multiple asset classes powered by our proprietary Artificial

Intelligence and machine learning Algorithms that provide timely and innovative insights, smart financial

planning, automated & personalised investment management solutions for Private & Public-Sector Banks,

Wealth Management Houses, Family Offices, Independent Financial Advisors,

New Age Payment Banks and

E-Wallets.

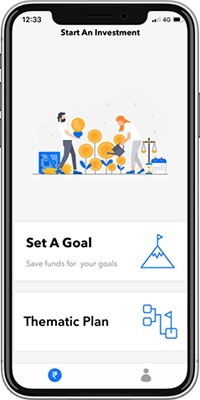

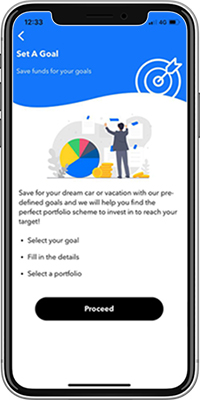

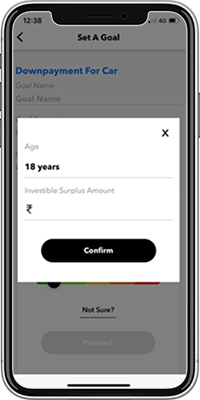

FinAurum

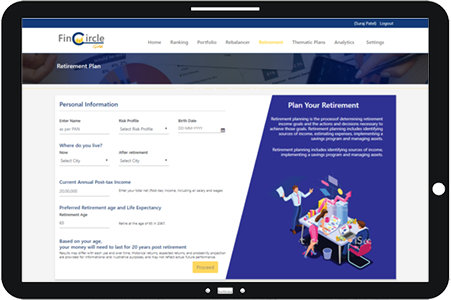

A Fully/semi-automated digital wealth management platform with white-labelled and customized variants. The

key modules cover On-boarding, Risk profiling, Paperless KYC, Asset Allocation, Portfolio

Creation,Execution, Portfolio Rebalancer, Goal based Investment, Retirement plan, Taxation Plan, Quick

Transact and Thematic portfolios. These are available as integrated and as modular API offerings.

Product innovations range from Hybrid variant of the Mutual Fund platform, advanced algorithms for

Portfolio Creation and monitoring as well as the path breaking predictive ranking methodology for Mutual

Funds.

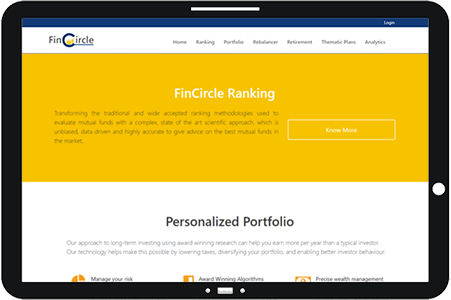

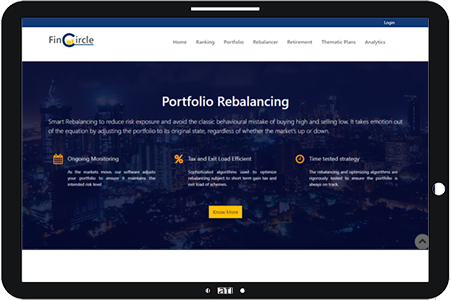

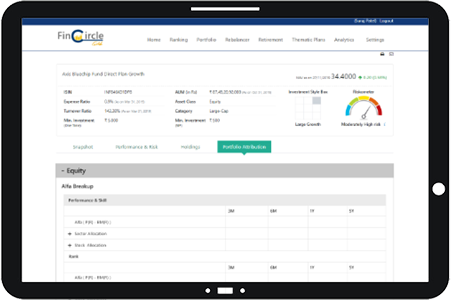

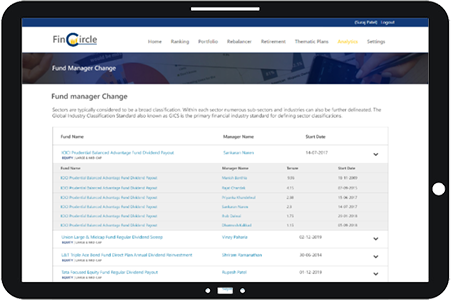

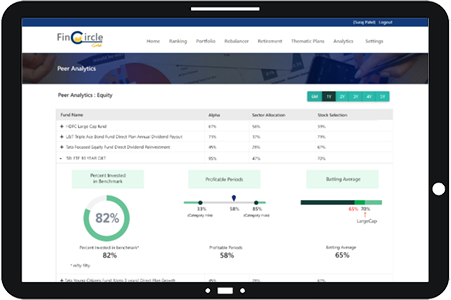

FinCircle

This is an advisory only product with an assortment of high value accretive modules powered by our proprietary Artificial Intelligence and machine learning Algorithms. The product is available in two variants and comprehensively caters to Private & Public-Sector Banks, Wealth Management Houses, Family Offices, Independent Financial Advisors, New Age Payment Banks and E-Wallets. The product enables high quality wealth management solutions, deepening of client engagement, higher client acquisition and enhanced retention

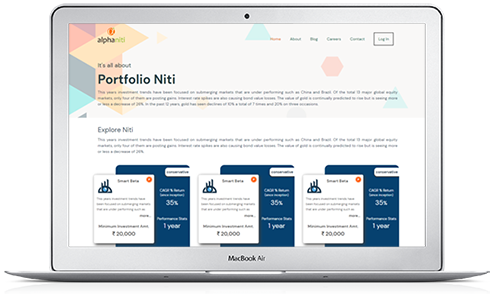

Equity

Our equity offering is centered around creating strategies that match the investor’s risk profile.

Alphaniti, our core digital offering, gives users access to a bouquet of unique strategies that are

carefully designed and rigorously back tested across market cycles to ensure robustness and avoid

survivorship bias. Our strategic tie-up with a US based Equity company allows domestic investors to invest

in US stocks under LRS.

In addition, the partnership provides access to an extensive library of strategies with existing

performance track record to be suitably adjusted to Indian markets and offered to domestic investors.

Also, a strong and highly competent domestic team has been engaged in building proprietary strategies that

strive to maximise alpha under different market conditions.

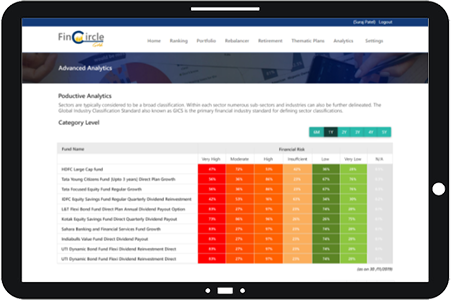

Advanced Analytics

A powerful library of research and tools to help advisors with comprehensive fund data and market-leading analysis. Our advanced analytics and predictive models provide cutting edge solutions, timely insights across bonds, equity and also specialized performance attribution. These analytics cater to banks, financial institutions, asset management companies, large wealth advisors and family offices.